Ask a layman, “how is your income tax computed?” You may get a blank stare! Accounting and tax laws determine what goes into calculating your taxes. This makes it hard to comprehend for many people. Yet at a high level, the process of computing income tax is straightforward, and it involves five steps: Determine assessable […]

Tag Archives: income tax

Under Ghana tax laws, you must file a personal income tax return for each year of assessment. A year of assessment is the tax year in which you make the income. Read on to understand what a personal income tax return is, and what goes in, so you file personal income tax returns that are […]

Are you a foreign national working in a country other than your home country? Or, you are a Ghanaian national, but you earn income outside Ghana. Who will tax your income? It depends on your tax residence. Your tax residence settles which countries can tax you. BASIS OF TAXATION If you are resident in Ghana […]

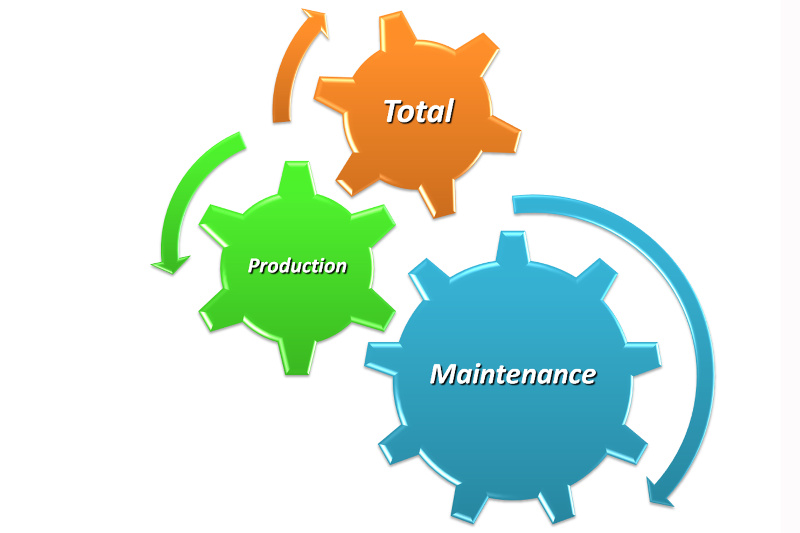

How Ghana tax laws undermine capital creation and private sector growth: The case of maintenance expenses. On January 1st, 2016 Act 896 of the Income Tax Act 2015 came into effect, superseding Act 592 of the Internal Revenue Act 2000. Act 896 made significant changes to the rules for deducting repairs and maintenance expenses. In […]