To achieve optimal tax outcomes and meet its financial requirements, you must prepare for the tax season. The extent of preparation depends on the business. With careful planning and attention to detail, you can meet the deadlines and get through the tax season with confidence. These tips are for SMEs (Small and Medium sized Enterprises) […]

Tag Archives: tax

The Ghana Revenue Authority (GRA) taxpayer portal is a work in progress. GRA often adds or changes features of the portal without adequate education and information. You often get to know of the changes when using the portal. At SCG, we are heavy users of the taxpayer portal, so we learn from our experiences. To […]

The Ghana Revenue Authority uses tax audits to ensure compliance and to increase tax revenue. It carries out both comprehensive and desk audits. The GRA’s approach is to focus its audit efforts on high-risk areas where the risk of noncompliance is high. VAT is one of the high-risk areas in their scope. In this article, […]

This blog answers common questions that people ask about tax audits. 1. What is a tax audit? A tax audit is an examination of a taxpayer’s financial records and tax returns by the GRA to ensure that the taxpayer has accurately reported their income, deductions, and credits and complied with tax laws and regulations. 2. […]

After you file a tax return on Ghana.Gov, it becomes a pending liability on the Pending Payment screen. Before you can make payment on Ghana.Gov, you must generate a tax bill from the Taxpayers portal for the tax type you have filed. Follow the steps below to make a payment. 1. Logon to taxpayersportal.com with […]

“How is tax on bonuses computed?” is a frequently asked question. This article discusses how we treat bonus taxes in a payroll computation. What is a Bonus? Bonus is an incentive pay given on top of the employee’s usual compensation (basic salary). Types of Bonus In our work as an outsourced payroll service provider, we […]

Under the Income Tax Act of 2015, an individual who has a mortgage can deduct interest paid during the year in calculating his taxes. When do you get the mortgage interest benefit? Do you get the benefit at the time you file your annual tax returns, or do you get it as you pay income […]

Ask a layman, “how is your income tax computed?” You may get a blank stare! Accounting and tax laws determine what goes into calculating your taxes. This makes it hard to comprehend for many people. Yet at a high level, the process of computing income tax is straightforward, and it involves five steps: Determine assessable […]

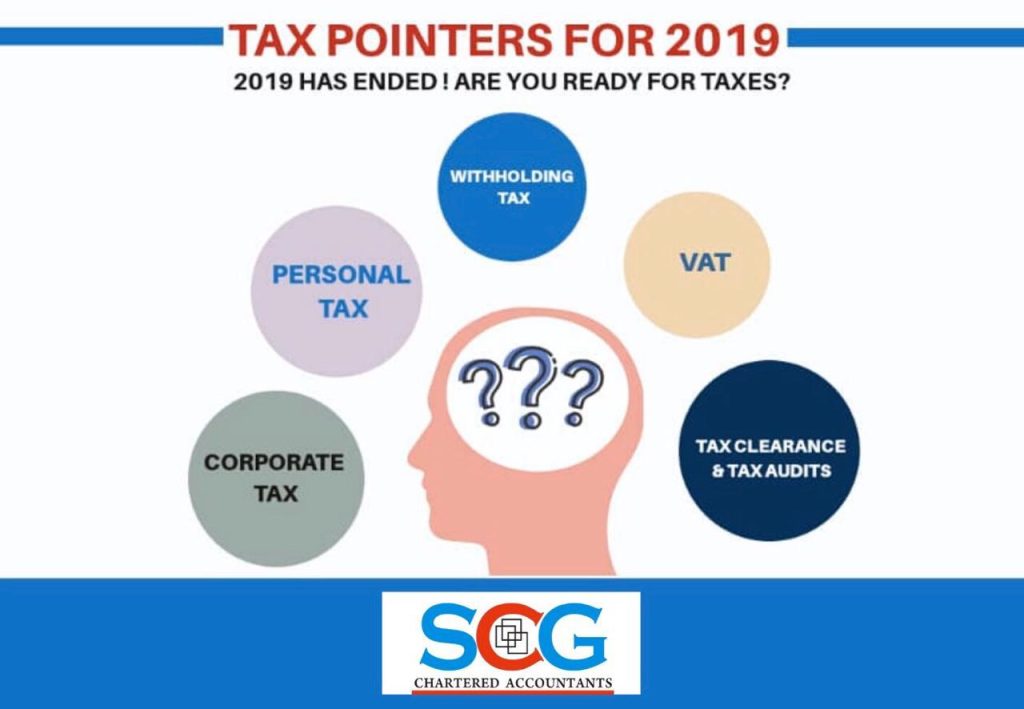

Early preparation is the best way to avoid tax trouble and reduce your taxes. This blog discusses the issues you must address as 2019 ends. So, what must you consider? Here’s a snapshot of the issues to ponder: Obtain Taxpayer Identification Number (TIN) for all your employees Withhold the appropriate taxes from all payments made […]

A company’s accounting year is the period for which it prepares its annual financial statements. It must consistently prepare its financial statements to that date. This enables users of financial statements to compare performance between years. Changing your accounting year has tax implications. It poses problems such as gaps or overlaps in income taxed. The […]

- 1

- 2