Introduction

In April 2023, the government of Ghana passed 3 amendments to the tax laws. Act 1094 to amend the Income Tax Act 2015 (Act 896). Act 1093 amends the Excise Duty Act 2014 (Act 878), and Act 1095 introduces the Growth and Sustainability Levy. The amendments are effective from 1st May 2023. Outlined below are the key highlights of these amendments:

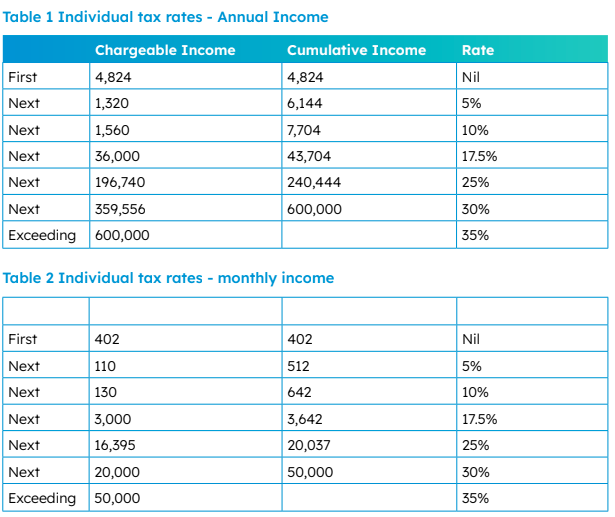

Amendment to the Personal Income Tax Bands

The personal income tax schedule has been revised. The revision adds a new band to tax income over GHS 600,000 at 35%.

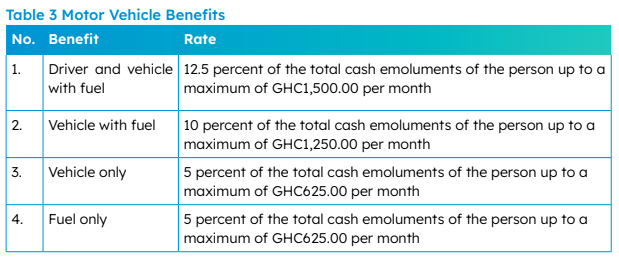

Motor vehicle benefits

The amendment increases the cap on the maximum amount that can be assessed on an

individual for car benefits.

Tax on gains from sale of assets or liabilities

Capital gains tax applies to individuals and businesses. An individual can opt to have his capital gains taxed at an optional rate or added to his other income and taxed at his marginal tax rate. The government has increased the optional rate from 15% to 25%.

The amendment also imposes an obligation to file a tax return to report such gains. Within 30 days of realizing the gain, you must file the return with the GRA. In addition, a business that purchases capital assets from a resident person must withhold tax at 3% of the purchase when they pay for the asset. If the payment is to a non-resident, the withholding tax is 10% of the purchase price.

For individuals, capital assets are significant pieces of property, such as homes, cars, investment properties, stocks, bonds, and even collections of art. For businesses, a capital asset is an asset with a useful life longer than a year that is not intended for sale in the regular course of the business’s operation.

Taxation of loss-making businesses

The amendment to Section 2 of the Income Tax Act 896 changes the basis for taxing loss-making businesses. A business that has declared losses for the previous 5 years will be subject to tax based on a minimum chargeable income of 5% of turnover. This provision excludes businesses in their first 5 years of operation and businesses engaged in farming.

Limit on the deduction of exchange losses

The amendment limits the deduction of foreign exchange capital losses, and foreign exchange losses arising from transactions between residents.

Foreign exchange capital losses

You can no longer deduct foreign exchange capital losses in calculating chargeable income. Foreign exchange capital losses arise from purchasing fixed assets in foreign currency. Fixed assets are assets with a useful life of more than a year.

For example, you take a foreign currency loan to purchase a fixed asset. The exchange losses that arise on this loan is a foreign exchange capital loss. Foreign exchange capital losses must be capitalized and written off through capital allowances.

Transactions between residents

A Ltd, a resident, bought property in a foreign currency from B, a resident. This is a transaction between two residents.

Foreign exchange losses from these transactions are not deductible in calculating chargeable income. This covers both operating and capital foreign exchange losses.

Loss carried forward

Act 1094 effectively abolishes the classification of industries into priority and non-priority sectors. The amendment allows all businesses to carry forward losses for a period of 5 years. You can offset such losses against profit in subsequent years to determine chargeable income.

Taxation of temporary concessions

The government gives a tax concession when it reduces the tax a particular group of people or businesses must pay. It makes concessions to encourage investment in a particular area or industry. The Ghana Government taxes certain industries at a tax rate of 1% for a period. This is a concession to encourage investment in those industries. Examples of businesses granted concessions are businesses in agriculture, Rural Banks, and residential properties.

In this amendment, the government has increased the tax rate for businesses with temporary concessions from 1% to 5%.

Withdrawals from provident fund or personal pension scheme

A contributor to a provident fund or personal pension fund may wish to withdraw funds to meet a need. If the contributor withdraws money from the pension fund before age 60, the retirement age, the fund withdrawn is subject to tax.

The amendment has abolished tax on pension fund withdrawal before age 60. Such withdrawals will no longer be taxable.

Taxation of Lottery Operations

The amendment changes the basis for taxing lottery operations. Tax on lottery operations will be based on their revenue, and not profit, as is the norm. The chargeable income is now the gross gaming revenue of lottery businesses. A tax of 20% applies to this income.

Gross gaming revenue is the total amount staked less any winnings. If a person has chargeable income from other sources besides a lottery operation, tax is based on the profit from those sources. Lottery operators are also now required to withhold 10% of gross winnings as withholding

tax.

Whilst the amending Act, Act 1094 specifically mentions lottery operations, read with the Gaming Commission Act, Act 721, this law will apply to the gaming industry, not just lottery operations.

Note: How will the lottery operators cover their costs? We are informed GRA is still having consultations with the industry players and await further clarifications from the GRA on how this mode of taxation will work.

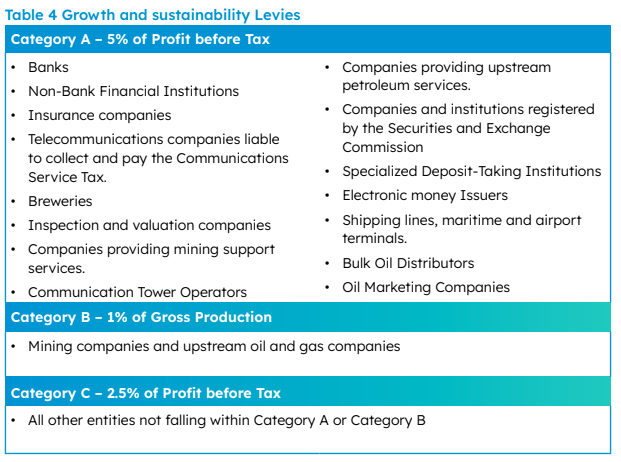

Growth & Sustainability Levy Act, 2023 (ACT 1095)

The Growth and Sustainability Levy (GSL) replaces the National Fiscal Stabilization Act, 2013 (Act 862). The GSL expands the pool of industries and entities subject to the levy.

The GSL imposes a levy on profit before tax or the percentage of gross production of specific companies and institutions for the 2023, 2024, and 2025 years of assessment.

GSL applies even if a company has a tax holiday or tax exemption. This levy is not deductible in computing chargeable income. The levy is payable quarterly.

Below are the categories of companies and the rate of levy applicable to their type of business.

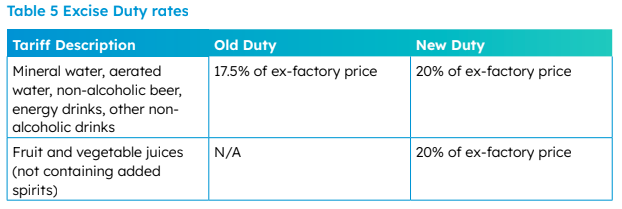

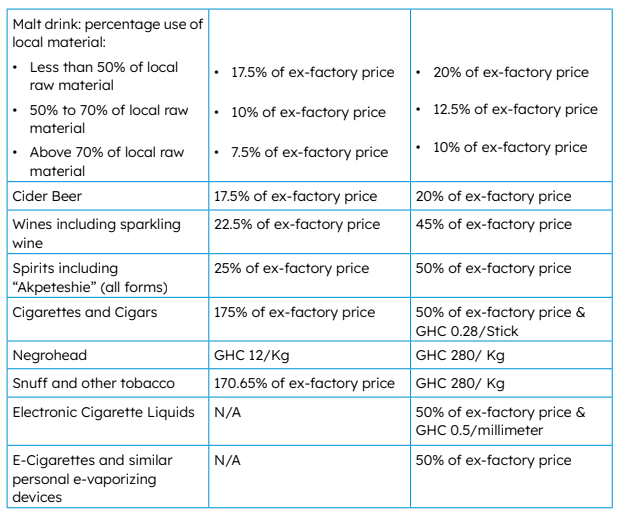

Excise Duty Amendment Act, 2023 (Act 1093)

The first schedule of the Excise Duty Act, 2014 has been amended to increase the excise duty charged on specific goods such as cigarettes and tobacco products, wine, malt drinks, etc. produced locally or imported into the country.

Act 1093 has also provided for new products such as electronic cigarettes and smoking devices to be included in the list of excisable goods in Ghana.

The table below shows the tariffs imposed on some goods.

Click here to download the full document in pdf.