A Tax Clearance Certificate (TCC) confirms a taxpayer has paid his taxes or has agreed on a payment plan with the Ghana Revenue Authority (GRA) at the date of application.

To remove the hassle from getting a TCC, GRA has moved from issuing physical TCC to issuing Electronic Tax Clearance Certificates (E-TCC). You can now apply for and get a TCC online through the Taxpayers’ Portal.

What conditions must one meet to get a TCC?

Your TCC application may be rejected because your taxes are not in order. To avoid rejection, ensure that at the time of your application, you have:

- Filed all tax returns, including financial statements, up to and including the last year of assessment.

- Paid all taxes, interests, and penalties due on the taxpayers’ portal.

- Where you disagree with the outstanding balance on your dashboard, reconcile and present the evidence to your tax office to correct the balance.

Steps In Applying for Tax Clearance Certificate

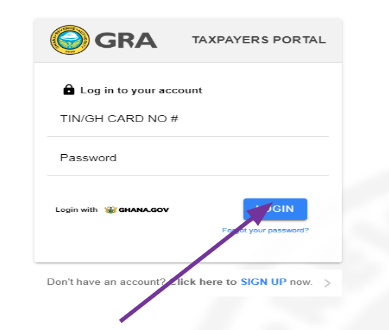

- Log into the https://taxpayersportal.com/ or the Ghana Taxpayers App.

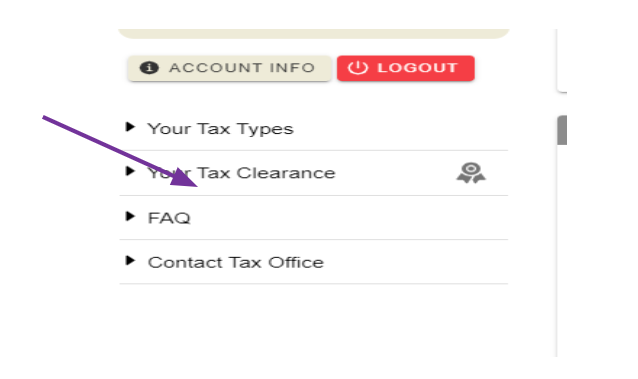

2. On the homepage, click on “Your Tax Clearance” on the left side of the page.

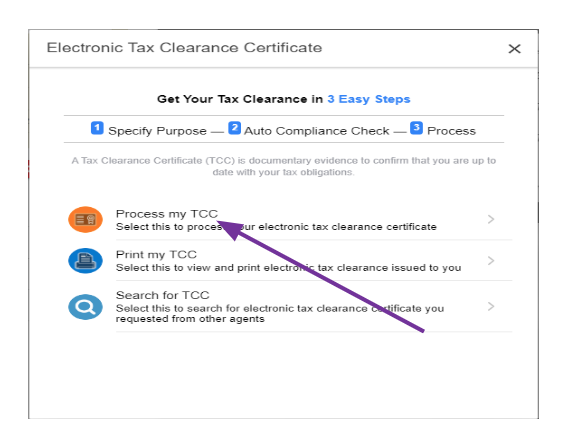

3. Click on ‘Process my TCC’ to start the process.

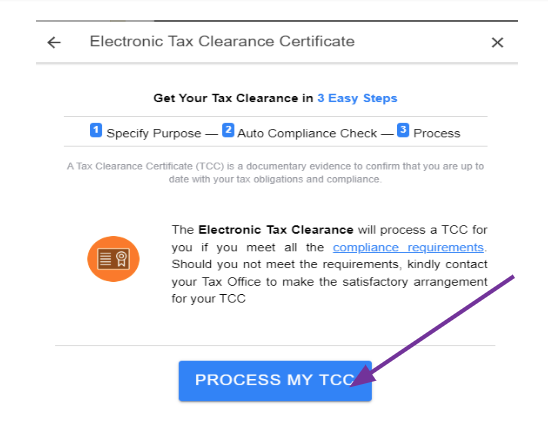

4. Next click on “Process my TCC” button to start the process.

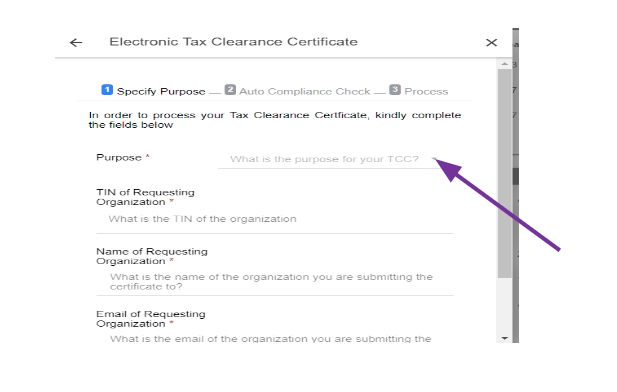

5. Select the Purpose by clicking on the drop-down arrow.

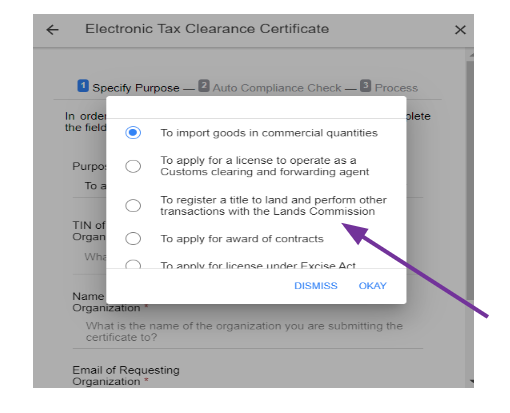

6. A list of purposes will appear as below. Select the one that applies to your TCC need.

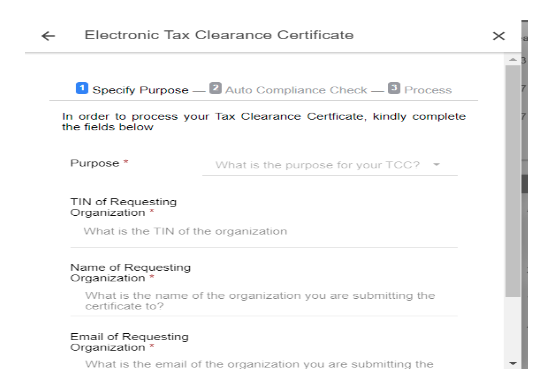

7. Fill in the “TIN of Requesting Organization” field with the name of the requesting organization. The name of the requesting organization and email fields will fill automatically.

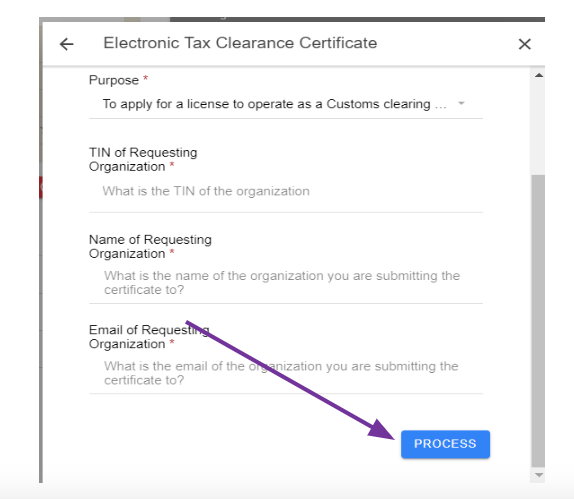

8. Click on ‘Process’ button.

When you click the process button shown above, the system checks your tax status. This is to ensure that you meet the requirements for the TCC.

Once the checks are complete, if you meet the requirements for a TCC the system automatically generates the E-TCC within minutes.